Can I charge tenants for solar power in California, Oregon, Hawaii, New Jersey, Delaware, Arizona, Massachusetts, etc.

By Alex ShahJanuary 15, 20243 min read

Short answers. Yes.

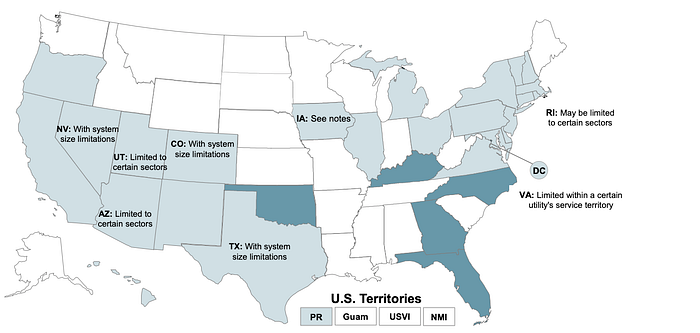

Charging tenants for power often involves a power purchase agreement (PPA) between the solar power owner and the tenant. With multifamily and commercial real estate, the solar power owner is also the property owner. States that explicitly allow PPAs also allow the property owner to sell power to their tenants. The following states allow power purchase agreements:

Some states have limitations on the size and type of system that may have a power purchase agreement:

Arizona: limited to schools, governments or other non-profit entities

Nevada: limited to systems generating no more than 150% of the average annual electricity consumption

Texas: limited to systems generating electricity no more than the average annual electricity consumption

Utah: limited to public buildings, schools or 501(c)(3) non-profits

Virginia: limited to solar systems between 50kW and 1MW within the certificated service territory, tax exempt entities are exempt from the minimum

Some state explicitly disallow selling of power to tenants, except for public utilities:

Florida

Georgia

Kentucky

North Carolina

Oklahoma

Here are some legal references to use of power purchase agreements by state:

Arizona: ACC Decision 71795, Docket E-20690A-09–0346

California: Cal. Pub. Util. Code § 218, § 2868

Colorado: S.B. 09–051; PUC Decision C09–0990, Docket №08R-424E (2009)

Connecticut: Clean Energy Finance and Investment Authority

Washington D.C.: REIP Program; PSC Order 15837 (2010)

Delaware: S.B. 266 and S.B. 267 (2010)

Florida: PSC Decision: Docket 860725-EU; Order 17009(1987)

Georgia: GA Territorial Act: O.C.G.A. § 46–3–1

Hawaii: S.B. 704 (2011)

Illinois: 220 ILCS 5/3–105, 16–102; 83 Ill. Adm. Code, Part 465

Iowa: Iowa Supreme Court, №13–0642 (2014)

Kentucky: KRS 278.010 (3)

Massachusetts: 220 CMR 18.00

Maryland: H.B. 1057 (2009)

Michigan: 2008 Public Act 286; PSC Order Docket U-15787

New Jersey: N.J. Stat. 48:3–51; N.J.A.C. §14:8–4.1 et seq.

New Mexico: H.B. 181 and S.B. 190 (2010)

Nevada: NRS 704.021 (AB 186, 2009); PUC Orders 07–06024and 07–06027

New York: NY CLS Public Service § 2.13

New Hampshire: PUC 902.03; PUC Docket DE 10–212 (letter1/31/12)

North Carolina: General Statutes § 62‐3(23)

Ohio: PUC Order 06–653-EL-ORD (11/05/2008)

Oklahoma: 17 Okl. St. § 151; O.A.C. § 165:40

Oregon: PUC Order, Docket 08–388; O.R.S §757.005

Pennsylvania: PUC Order, Docket M-2011–2249441

Puerto Rico: No policy reference available; based on news reports and articles

Rhode Island: R.I. Gen. Laws § 39–26.4 (2011)

Texas: S.B. 981 (2011)

Utah: H.B. 0145 (2010)

Vermont: No policy reference available, based on news reports and communications

Virginia: S.B. 1023 (2013)

Click here for detailed explanation of how to charge tenants in California

Click here for detailed explanation of how to charge tenants in Massachusetts

* U.S. Department of Energy Study on 3rd Party Solar PPAs

Interested in learning more? Check out Energy311’s Blog!